Solayer Chain: Advancing Blockchain Scalability

Executive Summary

The blockchain industry has experienced exponential growth over the last decade, driven by the increasing adoption of decentralized applications (dApps), smart contracts, and tokenized assets. However, as demand rises, existing blockchain infrastructures face significant challenges, including scalability bottlenecks, high latency, and fragmented ecosystems. Solayer Chain addresses these issues with its innovative hardware-accelerated blockchain architecture, Infinitely Scalable Solana Virtual Machine (InfiniSVM), delivering advanced throughput and efficient composability.

1. Introduction to Solayer Chain

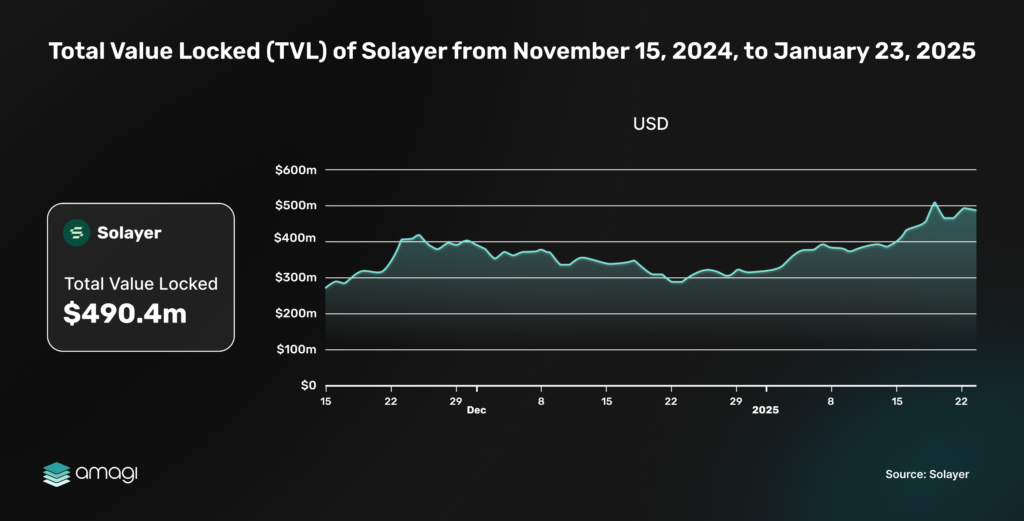

Solayer began as a restaking protocol to enhance the utility of staked assets on Solana. Launched in May 2024, it attracted $24.2M in SOL and Liquid Staked SOL deposits shortly after launch, reaching its initial cap. Solayer has been operating without a native token, focusing primarily on unlocking greater value for staked SOL by enabling users to support and interact with additional layers of decentralized applications (dApps).

Solayer Chain aims to solve scalability bottlenecks faced by networks like Solana, where rising demand has led to congestion and increased fees during peak usage. To address these challenges, Solayer leverages the Solana Virtual Machine (SVM) and introduces its InfiniSVM architecture, which employs parallel transaction processing to improve efficiency. This approach allows Solayer to maintain compatibility with Solana while targeting dynamic scalability to adapt to fluctuating network demands.

Figure 1: Total Value Locked (TVL) of Solayer from November 15, 2024, to January 23, 2025

2. Technological Innovations

Solayer stands out in the blockchain space by introducing advanced technological advancements that address critical challenges such as scalability, efficiency, and interoperability. The platform leverages its proprietary InfiniSVM architecture, a hybrid consensus mechanism, and advanced database sharding to deliver high performance and adaptability.

2.1 InfiniSVM Architecture

- Solayer’s InfiniSVM enables the blockchain to handle unlimited transactions and users by dynamically dividing workloads across smaller execution units. This approach ensures that the network remains scalable and efficient, even during periods of high demand.

- Unlike traditional systems like Ethereum’s Layer 1 chain or Bitcoin’s sequential transaction model, which often experience bottlenecks, InfiniSVM balances the load seamlessly, maintaining reliability and consistency for all participants.

2.2 Hybrid Proof-of-Authority-and-Stake Consensus

Solayer employs a novel hybrid consensus model, combining the strengths of Proof-of-Authority (PoA) and Proof-of-Stake (PoS) to ensure efficiency and security.

How It Works:

- Mega Leaders: Trusted validators execute transactions swiftly, ensuring high-speed processing.

- Stake-Based Verification: Additional validators verify transactions based on staked assets, enhancing decentralization and fairness.

- Optimized Throughput: This hybrid Proof-of-Authority-and-Stake consensus model allows Solayer to achieve transaction speeds of over 1 million transactions per second (TPS), far surpassing most existing blockchain solutions.

2.3 Advanced Database Sharding

- To manage the increasing size and complexity of blockchain data, Solayer employs database sharding, a technique that divides the data into smaller, more manageable pieces.

- This approach allows faster data access and retrieval while ensuring the system remains scalable as the network grows.

3. Unique Features of Solayer Chain

Solayer Chain’s unique features showcase its commitment to enhancing user experience and expanding blockchain functionality. These features are designed to accommodate a wide range of use cases while ensuring accessibility and efficiency.

3.1 Native Yield-Bearing Assets

Solayer introduces sSOL and sUSD, tokens that enable participants to earn rewards through staking mechanisms. These rewards are distributed as incentives for supporting network operations, such as securing the blockchain or participating in governance. This feature enhances network security and provides participants with a source of passive income, ensuring active contribution to the ecosystem.

3.2 Hooks: Automated Post-Transaction Logic

Hooks allow users to automate specific actions following transaction completion. For example, users can configure Hooks to automatically execute predefined arbitrage strategies when price discrepancies arise or to initiate liquidation processes when collateral thresholds are breached. By reducing the reliance on manual intervention, Hooks streamline complex workflows and significantly improve operational efficiency.

3.3 Jumbo Transactions

The ability to process large and complex transactions in a single execution is a standout feature of Solayer. For example, decentralized finance (DeFi) users can execute strategies such as multi-token swaps across liquidity pools or bundled lending and borrowing actions in one transaction. Jumbo transactions eliminate the need for multiple steps, saving time and transaction costs.

3.4 Cross-Chain Operability

Solayer facilitates seamless interactions across blockchain networks, allowing users to transfer assets and data effortlessly. For example, users can bridge assets across Solana and Ethereum, which reduces fragmentation and fosters a more interconnected blockchain ecosystem. This existing functionality highlights Solayer’s commitment to enabling cross-chain operability, with future potential expansions to include additional blockchain networks.

3.5 Enhanced Accessibility

Accessibility is a core focus for Solayer. Features like OAuth login options allow users to connect with the platform through familiar authentication methods, such as Google or Facebook. Additionally, wallet compatibility ensures support for a wide range of digital wallets, including MetaMask, Phantom, and Ledger, making it easy for users with different preferences to interact with the platform. This commitment to inclusivity lowers the barriers to entry, encouraging broader adoption of blockchain technology.

4. Tokenomics of Solayer

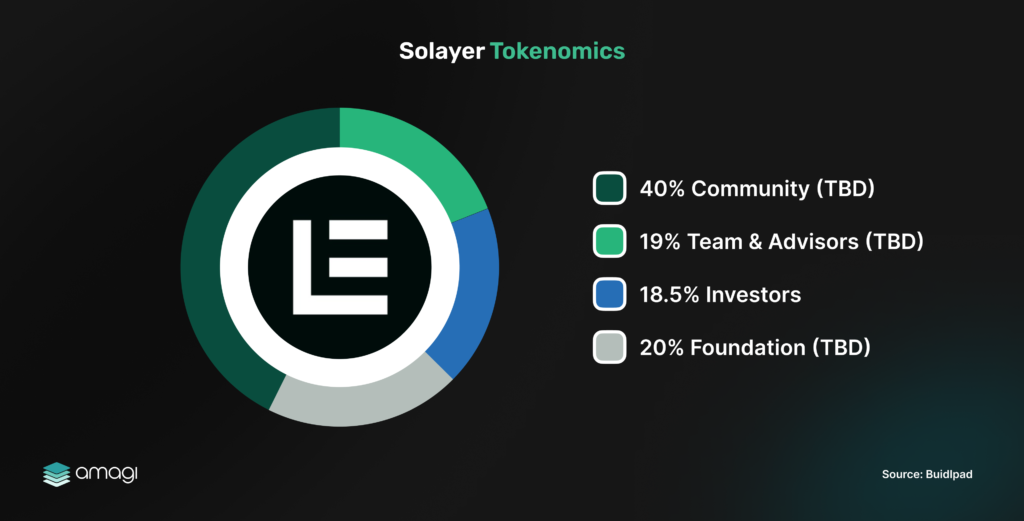

The native token of Solayer, LAYER, forms the backbone of the network’s economy. It is pivotal in incentivizing participation, facilitating transactions, and enabling governance.

Figure 2: Solayer Tokenomics

4.1 Utility of LAYER

- Transaction Fees: LAYER tokens are used to pay for transactions, ensuring sustainable network operations.

- Staking and Restaking: Participants can stake LAYER tokens to secure the network and earn rewards. Restaking allows additional yield generation by securing specific dApps.

- Governance: Token holders have voting rights, enabling them to influence key decisions related to network upgrades and policies.

4.2 Emission Schedule

Solayer employs a deflationary model with a fixed token supply cap. New tokens are distributed through staking rewards and ecosystem incentives. The limited supply ensures long-term scarcity, promoting value appreciation over time.

4.3 Incentives and Ecosystem Growth

- Staking Rewards: LAYER tokens are distributed to stakers as rewards, creating a sustainable incentive mechanism.

- Adoption Initiatives: Solayer has partnered with multiple dApps and DeFi platforms to expand LAYER’s utility and drive adoption across ecosystems:

- Meteora: Introduced the sSOL-SOL pool to provide dual incentives, boosting yields for SOL assets.

- Binance Wallet: Enabled BNSOL restaking with enhanced rewards and Solayer Boost through Binance’s DeFi strategies.

- Pyth Network: Integrated sSOL into Pyth’s Oracle system to support price feeds and enhance compatibility with DeFi applications.

5. Launch Strategy and Buidlpad Integration

Solayer’s token sale strategy has been meticulously crafted to maximize visibility, attract early adopters, and establish a strong foundation for ecosystem growth. The project’s collaboration with BuidlPad, an emerging launchpad platform, ensures a smooth and impactful entry into the market.

5.1 Initial Launch on Buidlpad

Buidlpad was chosen as Solayer’s launch platform for its extensive community reach and comprehensive support infrastructure. The collaboration provides Solayer with:

- Broad Audience Reach: Buidlpad’s established user base ensures maximum participation during the initial token sale.

- Robust Features: Buidlpad offers innovative features such as social referral programs, engagement opportunities to increase token allocation, and a scoring system for investors based on on-chain participation and holding records. These features simplify the launch process and enhance user experience, enabling seamless execution.

5.2 The Story Behind the Success

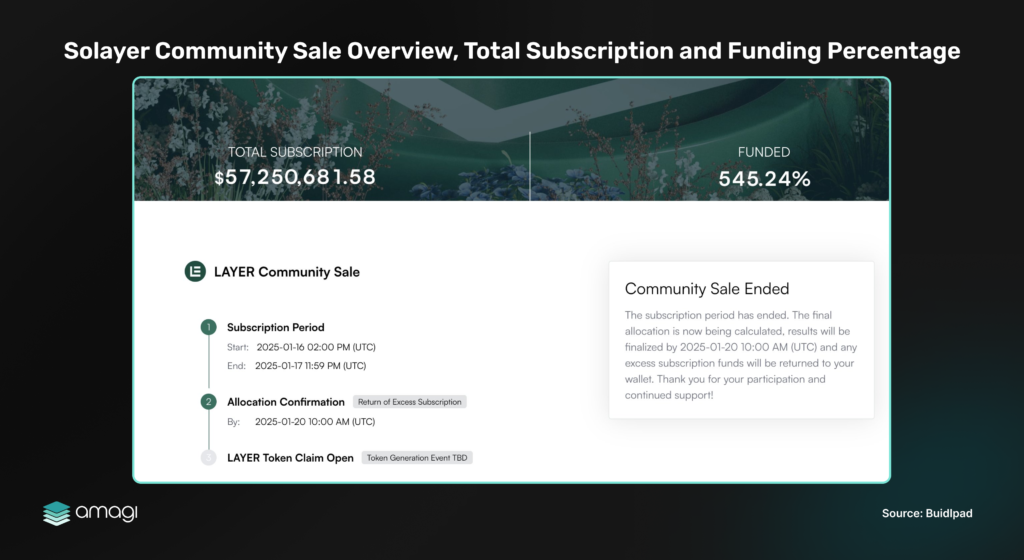

The community sale marked a significant milestone for Solayer, showcasing the platform’s ability to attract widespread interest and investor confidence. Initially scheduled for January 13, 2025, the event was postponed to January 16 due to an overwhelming response, with registrations exceeding expectations 15 times. This delay allowed Solayer and Buidlpad to implement fairer distribution measures and address potential issues related to bot activities and duplicate accounts.

The postponement was a collaborative decision to ensure transparency and inclusivity. By prioritizing equitable token allocation and enhancing security measures, the teams behind Solayer and Buidlpad successfully turned a logistical challenge into an opportunity to strengthen community trust.

5.3 Achievements During the Community Sale

The community sale’s results underscored the demand for Solayer’s innovative blockchain solutions. Key highlights include:

- Oversubscription: The sale was oversubscribed by 545%, with total subscriptions reaching $57,250,681.58, demonstrating immense interest in Solayer’s vision and potential. However, this also meant that only 18% of deposited funds were utilized for token purchases, with the remaining amounts refunded to participants.

- Engagement Metrics: Solayer’s campaign attracted a diverse global audience, reinforcing the platform’s appeal across various demographics and markets.

- Milestones: Despite challenges, Solayer allocated tokens to its target participants while maintaining system integrity.

Figure 3: Solayer Community Sale Overview, Total Subscription, and Funding Percentage

5.4 Challenges and Lessons Learned

The token sale was not without difficulties. While the postponement and oversubscription highlighted Solayer’s popularity, they also exposed areas for improvement:

- Refund Delays: Participants also faced delays in receiving refunds. They were initially promised for January 20, 2025, but later postponed until after the Token Generation Event (TGE). Since the TGE date has not yet been confirmed, this adjustment has caused dissatisfaction among some community members, raising concerns about communication and transparency.

- KYC and Eligibility Issues: The community was frustrated by Inefficient Know Your Customer (KYC) processes and eligibility criteria discrepancies, which highlighted the need for more explicit guidelines and improved user onboarding.

- Communication Gaps: Feedback indicated that Solayer Labs could improve its communication strategy to address community concerns and manage expectations during high-stakes events.

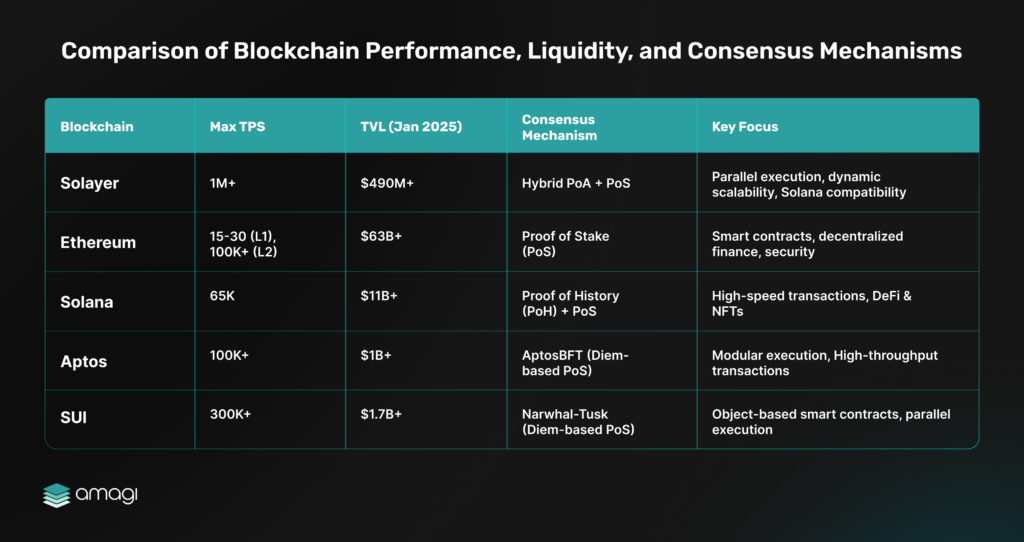

6. Competitive Analysis

The blockchain landscape is highly competitive, with various ecosystems offering distinct scalability, consensus mechanisms, and interoperability approaches. Solayer positions itself as a scalable and execution-focused chain that expands on Solana’s architecture while introducing dynamic workload distribution via InfiniSVM.

To evaluate Solayer’s market position, we analyze it alongside blockchain platforms like Ethereum, Solana, Aptos, and SUI. While all prioritize scalability and execution efficiency, each employs distinct architectural strategies.

6.1 Comparative Overview

The following table highlights key differences between Solayer and competing blockchain networks:

Figure 4: Comparison of Blockchain Performance, Liquidity, and Consensus Mechanisms

6.2 Ethereum vs. Solayer

Ethereum is the leading smart contract platform known for its robust security and liquidity. However, its monolithic execution model often results in congestion and high fees during peak periods.

- Scalability: Ethereum L1 processes only 15-30 TPS, requiring L2 rollups (e.g., Arbitrum, Optimism) to scale. While these improve throughput, they fragment state liquidity, a problem Solayer sidesteps using a single atomic execution environment.

- Security & Decentralization: Ethereum’s mature validator network and extensive ecosystem of L2s establish it as a leader in security and decentralization. Newer blockchain platforms like Solayer often struggle to match this level of security and liquidity.

- Developer Ecosystem: Ethereum’s strong developer community and tooling (e.g., Solidity, EVM) present a significant competitive advantage. To compete, Solayer would need to attract developers with incentives and ensure seamless compatibility with Solana.

Key takeaway: While Solayer’s architecture positions it to outperform Ethereum in terms of scalability and composability, Ethereum’s network effect, liquidity dominance, and developer ecosystem remain significant hurdles for Solayer to overcome.

6.3 Solana vs. Solayer

Solana is the closest comparable blockchain to Solayer, as both use parallel execution and the Solana Virtual Machine (SVM).

- Consensus & Execution: Solana uses Proof of History (PoH) to order transactions and Proof of Stake (PoS) for security, creating a high-speed but rigid pipeline prone to congestion during peak demand. Solayer’s InfiniSVM decouples execution from consensus, dynamically redistributing workloads across nodes to scale horizontally – like adding servers to a cloud – rather than pushing a fixed set of validators harder. This design aims to prevent the network-wide slowdowns Solana faces under load.

- Throughput & Cost Efficiency: Solana’s theoretical ~65K TPS often falters under real-world demand, leading to downtime and volatile fees. Solayer’s adaptive execution model targets a more stable cost-performance ratio, even during traffic spikes.

- Liquidity & Ecosystem: Solana’s $1.8B TVL and established dApp network give it a significant lead. Solayer can tap into cross-chain liquidity via native Solana compatibility, but incentivizing ecosystem migration remains critical.

Key takeaway: Solayer builds on Solana’s architecture with dynamic scalability improvements, but network reliability and adoption will determine its true edge.

6.4 Aptos vs. Solayer

Aptos is a high-throughput blockchain optimized for low-latency applications, while Solayer prioritizes dynamic scalability and Solana compatibility.

- Consensus & Execution: Aptos evolved from Meta’s Diem project, utilizing the AptosBFT consensus, a Diem-based PoS model. Solayer’s hybrid PoA+PoS model differs by emphasizing validator hierarchy for execution efficiency.

- Scalability & Performance: Aptos targets ~100K TPS, focusing on modular execution pipelines. Solayer scales dynamically by auto-adjusting resources based on real-time demand, a “just-in-time” approach compared to Aptos’s fixed infrastructure.

- Adoption & Ecosystem: Aptos leverages the Move language, which embeds security guarantees (e.g., resource-oriented programming) directly into its VM. This appeals to developers who prioritize formal verification. In contrast, Solayer is compatible with the Solana Virtual Machine (SVM), lowering migration barriers for Solana developers.

Key takeaway: While both chains prioritize execution efficiency, Aptos’s modular design and Move-language security cater to institutional-grade applications, whereas Solayer’s dynamic scaling and Solana alignment focus on attracting existing Web3 developers.

6.5 SUI vs. Solayer

SUI is a high-performance blockchain specializing in object-based smart contracts and parallelized execution. Solayer emphasizes adaptive workload scaling and Solana compatibility.

- Consensus & Execution: SUI employs the Narwhal-Tusk consensus mechanism, designed for optimized throughput. Solayer’s hybrid PoA+PoS model offers a different approach, balancing validator efficiency with network decentralization.

- Scalability & Performance: SUI targets ~300K TPS and focuses on object-based transaction handling, which allows assets to be processed independently. Solayer, in contrast, dynamically scales workloads rather than concentrating on object-based execution models.

- Adoption & Ecosystem: SUI also uses Move for smart contract development, catering to security-conscious developers. Solayer’s compatibility with SVM allows easier integration with existing Solana applications.

Key takeaway: SUI and Solayer prioritize execution efficiency. However, SUI’s object-centric architecture excels at parallelizing asset-heavy applications (e.g., gaming, DeFi), whereas Solayer’s dynamic resource allocation offers flexibility for unpredictable workloads.

7. Market Implications

Solayer’s infrastructure holds significant potential to reshape various sectors by providing solutions that combine scalability, security, and user-centric design. Its applications span multiple industries:

7.1 High-Frequency Trading

Solayer’s high-throughput architecture is tailored for environments requiring rapid transaction processing and precision. Its infrastructure can handle the demands of high-frequency trading, ensuring consistent performance and reliability during periods of intense market activity.

7.2 AI Agents and Infrastructure

Solayer provides the decentralized infrastructure needed to support artificial intelligence systems. By offering scalable and secure compute environments, Solayer enables the efficient operation of AI agents and fosters infrastructure development for data-intensive applications.

7.3 Consumer and Social Networks

With a focus on decentralization, Solayer aims to transform consumer and social platforms by enhancing data privacy, ensuring secure interactions, and enabling user data ownership. This approach creates a more transparent and user-centric foundation for social networks.

7.4 Real-World Assets (RWA)

Solayer’s platform has the potential to facilitate the tokenization of real-world assets, bringing transparency and efficiency to industries like real estate and supply chains. Solayer could redefine how physical assets are represented and exchanged on-chain through decentralized tracking and management.

7.5 Decentralized GPU Clusters

Solayer’s infrastructure supports the development of decentralized GPU networks, providing distributed computational power for high-demand tasks. This capability enables cost-effective and scalable solutions for industries that rely heavily on GPU resources, such as AI, graphics rendering, and scientific research.

7.6 Your Novel Use Case

Solayer’s modular and flexible design empowers businesses and developers to create tailored decentralized solutions. Whether addressing supply chain challenges, building identity systems, or developing entirely new applications, Solayer provides the tools and infrastructure necessary to innovate across industries.

8. Challenges and Risks

While Solayer’s innovations and features position it as a transformative platform, several challenges and risks must be addressed to ensure its continued growth and success. These challenges are inherent to building and maintaining a cutting-edge blockchain network.

8.1 Adoption Barriers

- Gaining traction in a highly competitive market requires clear differentiation. Solayer must demonstrate its superior speed, cost-effectiveness, and usability to attract developers and users. Building trust within the community will be crucial to overcoming hesitations about adopting a new platform.

8.2 Cost of Infrastructure

- The advanced infrastructure that powers Solayer, such as InfiniSVM and database sharding, comes with significant operational costs. Striking a balance between innovation and affordability will be key to maintaining a broad user base.

8.3 Regulatory Uncertainty

- The blockchain industry operates under rapidly changing regulatory conditions. Ensuring compliance without compromising decentralization or user trust is challenging yet essential. Proactive engagement with regulators and transparent communication will help mitigate these risks.

8.4 Security Considerations

- Advanced technologies can introduce potential vulnerabilities. Continuous testing, rigorous updates, and collaboration with the community will be vital in ensuring the platform’s resilience against emerging threats.

9. Conclusion and Outlook

Solayer Chain is a novel blockchain solution addressing long-standing scalability, interoperability, and composability challenges. By leveraging its InfiniSVM architecture, hybrid consensus, and advanced ecosystem features, Solayer is enhancing the infrastructure of decentralized applications. Below are key takeaways that highlight its current position, market reception, and the path forward.

9.1 Competitive Position

Solayer stands out in the highly competitive blockchain landscape by blending horizontal scalability with seamless cross-chain operability. Unlike EigenLayer, which focuses on restaking to secure middleware within Ethereum, or LayerZero, which offers lightweight messaging protocols for interoperability, Solayer integrates these elements with hardware-accelerated execution and advanced tooling like automated workflows (Hooks).

This unique approach enables Solayer to:

- Expand Solana’s computational bandwidth without compromising performance.

- Deliver unified cross-chain liquidity and interaction, surpassing many Layer 2 solutions.

- Position itself as an essential scaling layer for dApps that demand high throughput and composability, setting a new standard for Web3 infrastructure.

By holistically addressing these needs, Solayer complements existing blockchains and creates a new category of infrastructure solutions tailored to high-demand applications.

9.2 Market Validation

The successful public token sale on Buidlpad is a testament to Solayer’s resonance within the Web3 community. With a 545% oversubscription rate and $57.25 million in total commitments, the sale highlights a strong interest and confidence in Solayer’s vision.

Key insights from the sale:

- Global Participation: The sale attracted a diverse audience, reinforcing Solayer’s appeal across multiple demographics and markets.

- Community Trust: Despite logistical challenges, the oversubscription showed a strong belief in Solayer’s technical and ecosystem potential, positioning it as a project with a loyal and engaged community.

- Momentum for Ecosystem Growth: This overwhelming response lays the foundation for further adoption and developer interest, signaling Solayer’s readiness to drive innovation across multiple industries.

9.3 Future Outlook

To sustain its growth and solidify its position as a market leader, Solayer must focus on the following priorities in the short term:

- Enhance Transparency: Addressing concerns surrounding the delayed TGE and refund timelines is critical. Regular updates on key milestones, such as TGE dates, partnerships, and development progress, will rebuild trust and reinforce Solayer’s commitment to its community.

- Catalyze Developer Ecosystem: By offering grants, developer-friendly tools, and incentivized programs, Solayer can attract builders to innovate on its platform. A thriving developer ecosystem will ensure the platform remains a hub for innovative dApps, driving adoption and showcasing real-world use cases.

- Strategic Partnerships: Partnering with industry leaders in gaming, finance, and artificial intelligence will showcase Solayer’s ability to power large-scale, high-performance applications. These collaborations will attract institutional interest, drive adoption, and solidify Solayer’s position as a transformative force in the blockchain ecosystem.

While Solayer’s technical advancements are promising, its long-term success depends on overcoming adoption barriers and proving utility against entrenched competitors.